Brenda Vingiello, Sand Hill's Chief Investment Officer, joined the Halftime Report to discuss the software space. This content was produced and provided by an unaffiliated

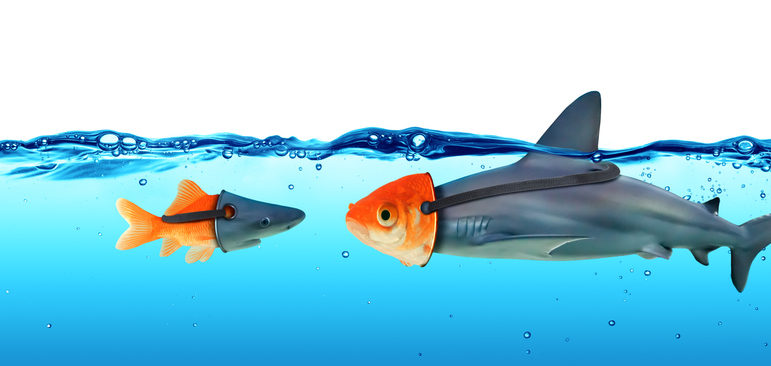

Your Equity Exposure: Is Your Proxy a Sector Match or a Bad Imposter?

The performance derived from individual stocks can be amongst the most rewarding portions of an investment portfolio. However, whereas a highly curated and diversified stock portfolio is more likely to provide a durable return, a smaller list of concentrated holdings may lead to a less appealing outcome. In this piece, we highlight the potential drawbacks of maintaining legacy stock positions whose best days may be behind them.

Have you ever found it frustrating when individual stocks you own don’t seem to replicate the return performance of the sector invested in? One would hope that if you own a stock in an oligopoly, that its performance would be highly correlated with its closest peer(s). The reality is single stock positions in the same peer group, facing the same market opportunity, often act very differently. When we come across positions that don’t track their underlying industry (or the intended investment theme), we label them as “imposters”. Unfortunately, investors often fall into the trap where they think “they are covered” with a position they expect will act as an adequate sector proxy, but instead the imposter causes an erosion of return in a portfolio.

The variation in individual stock returns so far in 2019 proves it can be difficult to expect that a sector proxy (or substitute) for one company over another will provide equal returns. In the bullet points below, we compare the total return of several large cap companies in the S&P to close peers on a year-to-date basis as of October 15th, 2019. For comparison purposes, the S&P 500 YTD is ~+ 20%.

- In Air Freight; United Parcel Service (UPS) + 22% vs. FedEx Corp (FDX) – 6%

- In Telcom Carriers; AT&T (T) + 41% vs. Verizon (VZ) + 12%

- In Materials (Paint); Sherwin Williams (SHW) + 43% vs. PPG Inc (PPG) + 17%

- In Apparel Manufacturing; V.F. Corp (VFC) + 38% vs. PVH Corp (PVH) – 5%

- In Technology Hardware; Apple Inc (AAPL) + 51% YTD vs. DELL +4%

- In Consumer Staples (Food); Mondelez (MDLZ) + 37% vs. Kraft Heinz (KHC) – 33%

The first example above depicts a scenario where, if an investor had been holding onto a legacy position in FedEx Corp (FDX) as a “proxy” for the airfreight and logistics industry, that they would have a negative return this year vs. United Parcel Service (UPS) which has had a return of over +20%.

Certainly, there have been years when the pairs listed above didn’t have such pronounced divergence in return. However, we are reminded that a company which might have been the sector leader historically, can lose their innovative spirit and become a laggard. To maintain leadership, a company needs to continually make intelligent decisions around key factors to drive respectable returns. A few of the key factors include the allocation of capital between research and development, capital expenditures, acquisitions and share buybacks while at the same time pruning their employee base to retain the best performers. We are also aware that the best companies mutate to fit the needs of the contemporary economy. Neither AT&T nor Apple offered the same products a dozen years ago and if they did, they wouldn’t have made it to the left side of the list above.

In summary, keeping an open mind to alternative potential holdings rather than hanging on to a legacy stock position for sentimental or capital gains tax minimization purposes is something that we advocate for at Sand Hill. Although there can be some reluctance to paying capital gains taxes, it can be therapeutic (and financially rewarding) to reallocate away from a legacy “imposter” position. In addition, the dividend stream from an underperforming equity position might seem appealing, but that yield rarely makes up for lost opportunity via investing elsewhere. We are long-term investors at Sand Hill, but rather than “set it and forget it”, we continually monitor our single stock positions and make adjustments if a particular company has a tough time, in our view, “keeping up with the Joneses”.

Please reference this chart and disclosures, which should be reviewed prior to or contemporaneously with this article.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.

Other Posts By This Author

- – When Macro Overwhelms the Micro

- – Weight a Minute: Will GenAI Transform Your Figure?

- – Welcome Back to an Economic Cycle

- – Are We in the Midst of “The Great Reset”?

Related Posts