“Things are strongest where they're broken.” – Louise Penny I began drafting this newsletter about the Federal Reserve in early January. The quote above is

The Short Rebate: What Is It and Why Should I Care?

Recently a client asked about the short rebate and whether it was to blame for disappointing hedge fund performance. We thought we would write about it here in case there were others with the same question.

What is the short rebate?

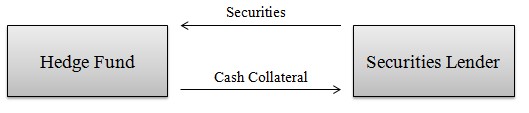

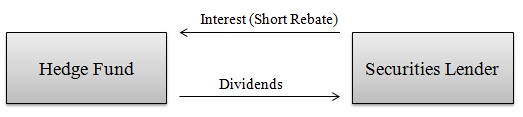

When a hedge fund shorts a security it must first borrow it. In order for the lender of the security to ensure that she is paid back she will insist on receiving collateral to secure the loan.

The borrower of the security will pay any dividends he receives from the borrowed security to the lender. The security lender will then pay the borrower some portion of the interest that she earns from the collateral. This interest payment is known as the short rebate.

Should I care?

Only if you are invested in hedge funds and, even then, only if your manager is using it as an excuse for disappointing performance. It is a poor one.

In the current environment of relatively high equity valuations and relatively low bond yields, it is important to attempt to diversify into investments that perform differently than traditional portfolios of stocks and bonds. One way to do this is through hedge funds, but not all hedge funds are created equal and manager selection is crucial. While it is not the first thing Sand Hill looks at when evaluating managers, we do consider whether or not they attribute disappointing performance to the short rebate.

There has been much written about the more high-profile performance challenges of hedge funds (including by me here), but there is one structural headwind that doesn’t often make the headlines: low interest rates. Low interest rates affect almost every hedge fund, regardless of strategy, because lower interest rates mean a lower short rebate. Hedge funds previously received a performance tailwind from interest earned on cash posted as collateral against their short positions. With interest rates close to zero, hedge funds no longer receive this interest (and in the case of European, Japanese, or harder to borrow U.S. stocks the fund might actually receive negative interest).

This applies to every hedge fund that sells securities short, and not just those that invest in fixed income products. In fact, any strategy that has a cash component to it will generate lower overall returns when cash only earns 0.25% or 0.5% interest, rather than the nearly 3.0% paid pre-financial crisis. The cash generated from shorting and, more specifically, the returns or “short rebate” earned on that cash have been a frequent source of frustration among some hedge fund managers of late. While there are some nuances and complexities to shorting stocks, the issue of the short rebate is basically another way of saying, “interest rates are low and we don’t make as much money on our cash as we used to.” One of my colleagues, Mark Strahs, attended an event recently where a hedge fund manager proclaimed, “If interest rates were 7%, I could generate that from the short rebate, so I could have a short position rally 7% and I’d still be flat.” Note to all hedge fund managers: If your performance is flat when interest rates are 7%, investors will not be impressed. Investors do not look at returns in a vacuum. They compare them to returns they can get elsewhere and if an investor can get 7% from a treasury bond, a 0% return from a hedge fund will probably lead to the investor asking for her money back.

Further complicating matters for hedge funds is the fact that the short rebate being paid is now below the dividend payout rate of the S&P 500. This matters because when you short a stock you have to pay out any dividends that the company pays while you are short. So the issue of short rebates’ effect on performance is not just that interest rates are low, it’s that interest rates are low relative to dividend payments. Is this an unusual phenomenon, which will reverse once interest rates rise? Some managers feel they might and indeed the yield on the 2 year note, for example, was higher than the dividend yield of the S&P 500 from at least the 1970s until 2008. But we’re not convinced that we will go back to that scenario. Prior to 2003, dividends were taxed at the same rate as ordinary income, so taxable shareholders preferred companies to buy back shares, which tends to boost share prices, creating capital gains rather than to pay dividends which would be taxed at the higher ordinary income tax rates. In 2003, the tax rate on dividends was lowered to the same rate as long-term capital gains. We have seen a somewhat steady increase in dividend yields since.[i] As interest rates normalize in the coming years, some of these headwinds may subside, but unless the tax code reverts to taxing dividends at higher rates, this “difficulty” of the short rebate could be here to stay.

Can’t funds just avoid shorting stocks with high dividends (or negative rates)?

Of course they could, but sometimes stocks with unsustainably high dividends have the greatest opportunity for capital depreciation. Fund managers generally take dividends and rebates into account when contemplating a trade, just as they always have.

So back to the question, why do we care about the short rebate?

Investing in this low interest rate environment has been hard and low rates have impacted a myriad of funds, not just the ones in the obvious strategies. It was easier for hedge funds to generate higher returns when interest rates were higher, but it was easier for almost every investor to generate higher returns then. Furthermore, the difference between the short rebate and dividends, while not a good excuse for relative underperformance, may not reverse itself any time soon.

There are thousands of hedge funds in the world and some of them are very likely to deliver high quality returns, but it is important to do thorough due diligence before investing. If a manager blames a period of weak performance on the short rebate take an even closer look and consider finding a different manager.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.