Sand Hill's Chief Investment Officer, Brenda Vingiello, CFA, joins Jenny Harrington on “Halftime Report” to go over their most recent portfolio moves. Brenda's commentary begins

There May Be More to Kids’ Movies Than You Think!

In my house we are running either the theme song from The Lego® Movie or the hit ballad from Disney’s Frozen on a continuous dizzying loop. Either my daughters are parading around the kitchen with their princess capes on – “letting it go” – or my son is pumping his fists in the air shouting “Everything is AWESOME.” Both songs can serve as appropriate lessons for personal financial management, and while I’ll refrain from specifically addressing sister princesses, a snowman named Olaf and animated Legos, I think a corollary can be drawn to the benefits of seeking professional financial advice, and the power of your team.

The theme song from Disney’s Frozen, “Let It Go,” underscores the emotional fears that control us and prohibit us from effective decision making. Only by letting go can we create emotional distance and become more “powerful” – and effective.

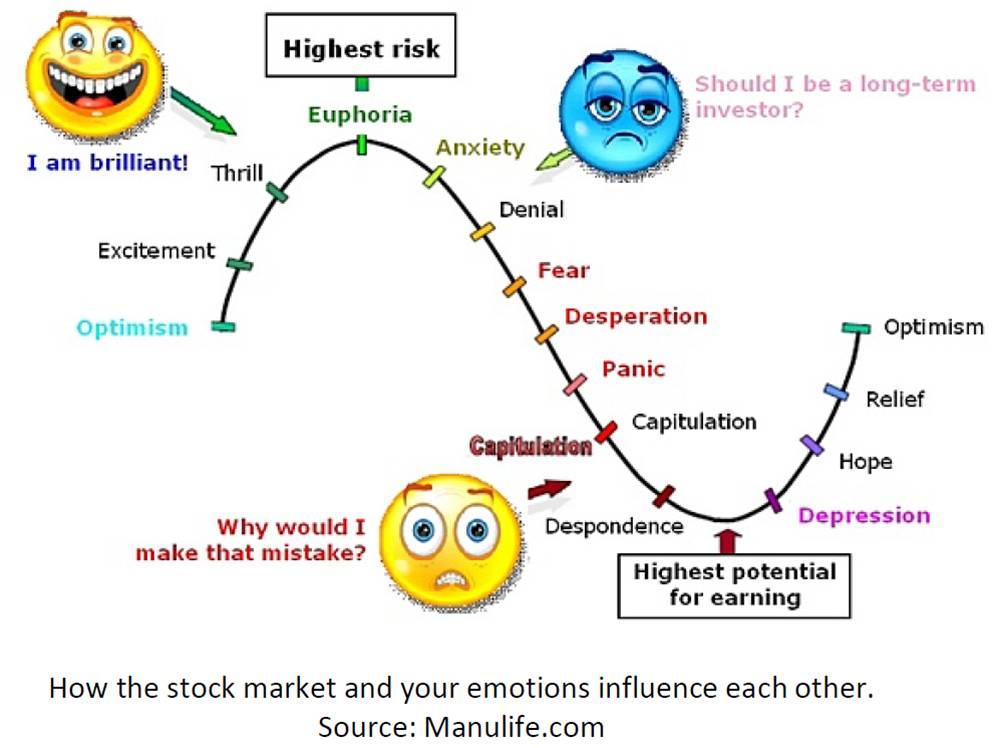

Markets, especially volatile ones, have the power to influence investors’ behavior; they can lead some investors to make poor or at least ill-timed investment decisions, inconsistent with their long term objectives. These emotional decisions can have a lasting impact on investment success over time. When emotions guide your investment decisions, many times you’ll end up in an emotional trading trap. Consider these scenarios:

• Say you sold everything to avoid a market sell-off – Congratulations! If you were lucky enough to time that step right, the decision of when do you buy back in is no easy trick. What clues and trends will guide you through this very emotional predicament? Investors can remain frozen for extended period, perhaps even entirely missing the benefits of a market recovery.

• Woohoo! The market is “ripping” and you buy because you “want some of THAT” – only for the market to begin a consolidation on bad economic data. What now?

It’s extraordinarily difficult to take the emotion out of such decisions. Professional investment advisors are trained to “wring out” the emotional distractions and exert the discipline needed to act in a contrarian way and resist following the crowd. ”Herd mentality” is usually what drives decisions when emotions run high. So what do people do in such periods? They tend to buy when the world and markets are looking strong, and sell when markets have turned negative – in other words: buy high, sell low.

You may want to “let go” of those emotional traps (at least a little) by hiring a professional manager, who has the discipline to manage your portfolio unemotionally and keep your strategy on track. No one completely escapes the angst, but minimizing it helps.

Enticing to another audience, Warner Brothers’ The Lego® Movie theme song, “Everything is Awesome,” subtly emphasizes the power and capabilities of a unified team. Like the Lego® team, if your team of advisors works well together, they can meaningfully improve your outcomes. To effectively protect your assets, they collectively and individually put a structure and strategy in place for you. Often, investors think of their attorney, CPA, insurance agent, or investment advisor by their respective specialties rather than as members of a cohesive team, working in harmony to construct, implement and manage their long term financial plan. Each of these specialists influence and help develop your optimal, individualized plan, geared to your circumstances and vision. It may even make sense to supplement the team with a banker, philanthropic advisor and/or real estate agent. Coordinating the team is often the job of your “wealth manager,” since that person is likely to be most frequently in touch, given the day-to-day nature of their work. Just as a team of medical specialists can best address your health and wellness, your team of financial specialists working together will build, integrate and manage your plan to steward your wealth. Understanding the role of each core member helps clarify how the pieces fit together:

Financial Advisor: Long term wealth solutions via financial planning and investment management for you and your family;

Estate Planning Attorney: Asset protection and providing for your family after you are gone;

Tax Advisor: Tax preparation and related planning strategies and expertise;

Insurance Advisor: Risk management strategies and asset protection.

In my personal experience, I have learned that teamwork strengthens the unique services of each member of the team. We work together in congruency with a client’s many moving pieces. Such an arrangement assures that I have a full understanding of your overall circumstances. That allows me to customize (really optimize!) the work I do for you.

Importantly, I can help fill gaps in your team by providing referrals to able members of the professional community. I work closely with your outside legal, accounting and insurance professionals to effectively integrate these areas into your plan. Your professional team is greater than the sum of its parts. They collectively provide integrated expertise and discipline for your benefit.

Like Legos, your team is a master creation of building blocks stacked into place for you and your family. The emotional stress of personal investing is eliminated so that you can “Let It Go” and enjoy other important aspects of your life, knowing your professional team is hard at work.

The bottom line? Surround yourself with experts – it’s a formidable team.

“Everything is Awesome” music and lyrics by Tegan and Sara, The Lego® Movie

“Let It Go” music and lyrics composed by Kristen Anderson-Lopez and Robert Lopez, Frozen

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.