Sand Hill's Chief Investment Officer, Brenda Vingiello, CFA, joins Jenny Harrington on “Halftime Report” to go over their most recent portfolio moves. Brenda's commentary begins

History Doesn’t Repeat Itself, But It Often Rhymes

“The arch of history is long, but it bends towards justice.” – Martin Luther King, Jr.

The future doesn’t seem to be what it used to be.

Global financial calamities last year, ranging from the ongoing European sovereign debt crisis to the unprecedented downgrade of our Treasury market, combined with the Japanese natural disaster, the end of “QE2,” Chinese growth concerns, and even wide spread global protests including the Arab Spring and Occupy Wall Street movements, have made 2011 a year that will be remembered for its almost unrelenting turmoil. Not surprisingly, against this backdrop of geopolitical events, investors have become quite pessimistic about the state of affairs in the world.

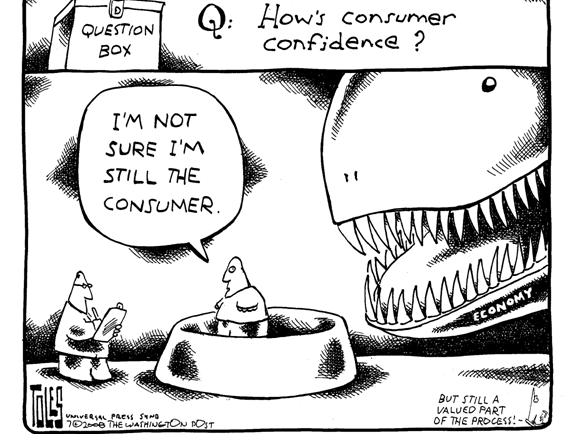

Meanwhile underneath these headlines, the economic recovery has proven to be remarkably resilient. Despite near universal calls for a double dip recession last year, US economic growth will be north of 2% in 2011. Job growth is accelerating. The home construction market is bottoming. Production, orders, and inventories are all rising. Yet oddly, there exists a “perspective gap” between the underlying strength of the economy – and just how poorly investors seem to feel about it. Why?

The overriding concern expressed to us last year was the sense that we are in unprecedented territory. With the 2008 Financial Crisis in our immediate rear view mirror, and as European leaders ready their own financial bazooka in 2012, investors look at government intervention with a jaundiced eye. Many investors believe that governments are behaving in a way that we have never before seen in history. But is that true?

Although these periods are certainly trying, and are fraught with higher than normal risk and volatility in the markets, it is also important to remember that government intervention, rather than being some unprecedented event, has actually been the norm – particularly over the last forty years:

In the 1970’s there was a massive crisis in state and local municipal bonds. The prevailing belief was that governments would never default on their obligations. Despite the conventional wisdom, a cash-strapped New York City was about to default on its debt. The potential domino effect of a municipal failure of this magnitude was deemed to be a systemic risk to the financial system. As a result, the federal government ultimately guaranteed New York’s debt – and later Lee Iacocca’s Chrysler Corporation as well. To many, this is now ancient history.

In the early 1980’s, after a period of rising commodity prices in the wake of the OPEC embargo, the prevailing insight was that we were entering a commodity super-cycle. The conventional wisdom of the day rationalized that investing in commodity-based countries – and third world government bonds in particular – was a good bet as rising commodity prices would mean sovereign states would never default on their debts. When commodity prices collapsed during the 1981-2 recession, third world countries began to default, threatening the financial system. The federal government, under then-Treasury Secretary Nicholas Brady, chose to bail out international bank debt, issuing “Brady Bonds” and rescuing the banking system. To many, this is now ancient history.

In the late 1980’s, commercial real estate prices collapsed. Financial institutions, particularly the savings and loans, having been allowed to venture beyond their traditional home mortgage market, had poorly chosen to follow the conventional wisdom of the day which assumed commercial real estate prices would continue to rise indefinitely. As the commercial real estate cycle rolled over, developers began to file for bankruptcy, and the underlying lending institutions collapsed. The federal government, deeming this event as a systemic risk, moved in with the creation of the Resolution Trust Corporation – buying up mortgage loans and properties from these insolvent institutions – and becoming the largest realtor in the country. To many, this is now ancient history.

The 1990’s were a relatively quiet period for federal government intervention, largely because the technology boom and the accompanying economic growth surge kept the financial tide high. Of course, this environment ultimately led to the Y2K stock market plunge, as well as a number of sloppy policy errors that contributed to the housing bubble and financial crisis in the 2000’s.

As we all remember well, in the 2000’s, the conventional wisdom was that residential housing prices would continue to rise ad infinitum. This made home mortgages a conservative investment opportunity – and for “sophisticated” Wall Street banks, the use of derivative mortgage instruments a “bet your balance sheet” opportunity. Of course, as in the previous examples, the core assumptions proved to be incorrect, housing prices fell, borrowers defaulted on their mortgages and the financial system became gravely threatened. Once again, the federal government intervened to prevent a systemic meltdown.

Today the markets are again wrestling with systemic risk, this time in the form of the European sovereign debt crisis. Once again, the underlying assumptions around sovereign debt have proven incorrect. Federal governments in Europe must now ultimately backstop the problem in order to combat a crisis that if left unchecked, would end the European Union and result in devastating economic outcomes. The complexity this time around is that we have 17 squabbling federal governments that must agree on its execution, but the final chapter of the story will be exactly the same.

Five times over the last forty years, investments that were considered conservative have failed spectacularly, threatening the stability of the financial system. Five times the government has intervened to prevent financial collapse. In every instance, the general consensus and news flow was that “things have never been as bad as things are now” and that we are at the end of our postwar economic boom. Yet in the aggregate, owning a balanced portfolio of financial assets resulted in superior long-term financial outcomes for those who could see beyond the pessimism of the moment.

Although we are certainly respectful of the complex global macro investment environment that exists today, as our walk through history suggests, we are not as pessimistic as the psychologically-frail consensus. Instead, we prefer to keep our historic bearings during this turbulent period. Staying calm when the world appears to be coming apart is not always deeply appreciated in the moment, but our long-term, contrarian discipline has served Sand Hill Global Advisors well over time.

In our offices hangs a collection of pieces that study asset bubbles over the arc of history – from tulip mania through today’s more recent experiences. It offers some perspective, and perhaps even a little inspiration, as we enter 2012. With the New Year comes our renewed resolution: to always keep one eye on the past and one on the future, to recognize that we’ve been here before and to realize that things in the end – well – they might just be alright.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.

Other Posts By This Author

- – A New Year’s Toast to the Silicon Valley Entrepreneur

- – How I Learned to Love the Bot

- – Thank You for Your Partnership

- – The Coming Deglobalization

Related Posts