Family governance is not a document you complete once and file away. It is a living system that grows and adapts just as the family

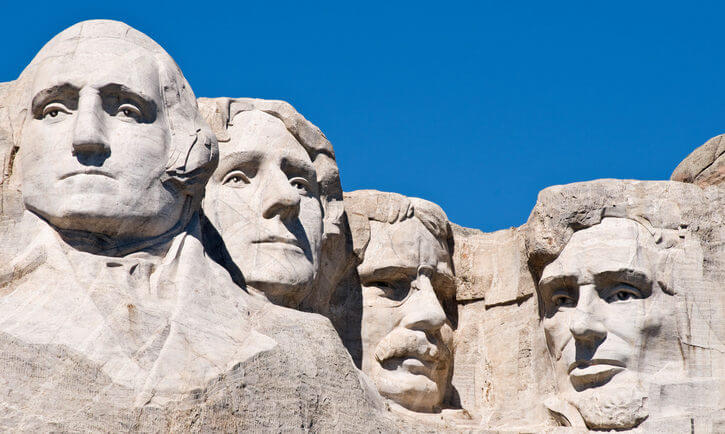

South Dakota’s Treasures: Rolling Hills, Sweeping Plains and Dynasty Trusts

From Mount Rushmore National Memorial to the Crazy Horse Memorial to the Corn Palace and Wall Drug, South Dakota offers numerous must-see attractions. You might ask what a state with a population of just 858,469 (as of July 1, 2015), less than the population of San Jose, California, the epicenter of the Silicon Valley and the richest city in the country (according to Bloomberg’s 2015 ranking of richest cities by gross metropolitan product) have to do with one another? The answer lies in South Dakota’s zero state income tax and its lenient trust laws in the country, which make it an interesting option for the very wealthy when considering impactful estate planning strategies for dynastic families.

Estate planning tools in South Dakota center on the use of dynasty trusts. Originally used by families like the Rockefellers and Carnegies, the intent of these irrevocable trusts is to protect wealth through several generations and the changing winds of different tax codes over time. Previously, laws against structures for perpetuity required such trusts to disband 21 years after the death of the last beneficiary alive when the trust was written. However, in 1983, South Dakota became the first state to allow for trusts to endure in perpetuity, essentially jumping outside the federal transfer tax system on estates. With no limit on the length of time a trust can exist, wealthy families can set up a trust within South Dakota and continue to disburse funds to their great-great-great (add as many “greats” as you wish) grandchildren untaxed, indefinitely. It is important to note that in response to perpetual trusts, Congress established the Generation Skipping Transfer Tax (GSTT) in 1986, which places limits on the amount of assets that can be passed to future generations free of federal tax.

While there are now 21 states, plus Washington, DC, that allow perpetual trusts, the primary reason that many utilize South Dakota to administer their generational wealth is that the state has no state income tax. Neither the assets contributed, nor income – capital gains, dividends, interest – generated from the trust assets, are taxed by the state of South Dakota. And at death, the state does not collect an estate tax on the funds.

South Dakota also goes the extra mile to shield trust assets in the event of a bankruptcy, lawsuit or divorce. Under friendly laws enacted by the state, an individual can transfer assets to a trust and receive benefits from that trust while still being shielded from creditors. Other protections are offered in the form of ironclad privacy laws, which allow courts to permanently seal records related to trusts with a simple petition.

Additionally, there are no residency issues, which is important for anyone enjoying the California climate or elsewhere. South Dakota law does not require the people investing in trusts established in their state to actually live there. It also allows families to control their own dynasty trust investments, rather than hiring trustees.

Another benefit is the state’s legislation around the creation of a Special Purpose Entity, a powerful planning tool that places a liability umbrella over the individuals serving in the roles of trust protector, investment committee, or distribution committee member, thus protecting them from personal claims from trust beneficiaries.

A family trust administered in South Dakota has the potential to last through the lifetimes of generations not yet born and the financial gains can be significant relative to trusts whose taxation erodes the remaining value over time. As with any irrevocable, multi-generational trust, you may have a lot of control over a dynasty trust, but your descendants may have very little. By the same reasoning, the trust income or property will have to be divided among more and more beneficiaries. If the grantor and each beneficiary have 2 children, then there will be 64 beneficiaries in the 6th generation. Depending on the size of the trust, this may become impractical to maintain. The 64 teams in a March Madness Basketball bracket comes to memory.

Needless to say, these trusts are complex and must be carefully explored with your investment advisor and estate planning attorney. There are distinct pros and cons, but under the right circumstances, they could be worth further consideration.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.