Sand Hill Global Advisors Brenda Vingiello joins CNBC Last Call to share her thoughts on the current markets. This content was produced and provided by

A Return to the Old Normal

The U.S. stock market performance during 2013 can be described as nothing other than extraordinary. Not only were new highs achieved, but overall return levels were the highest in 15 years for the S&P 500 and the highest in 18 years for the Dow. While the markets rose significantly, the underlying economic condition was less robust: higher taxes, sequester-imposed budget cuts, and a shrinking public sector served as a drag to overall growth. So what drove such outstanding market performance in a slow-growth environment?

While corporate earnings rose commensurate with the economic growth, the short answer is multiple expansion. Market performance is primarily driven by expectations regarding future growth of corporate earnings and the multiple the market assigns these earnings. Earnings multiples are influenced by growth rates, interest rates, and an overall view of risk. Typically they also incorporate a heavy dose of emotion, which can be euphoric or fearful. The price to earnings (P/E) ratio is a common measure of the market multiple.

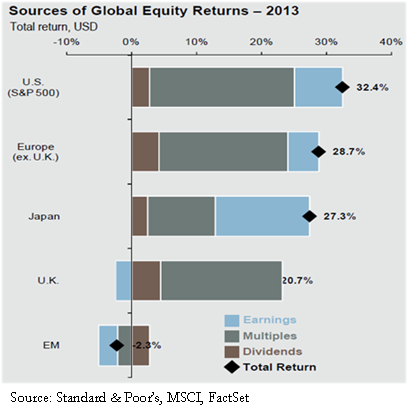

From 2008 through 2012, multiples were below-average as uncertainty over the global economic outlook persisted with Europe remaining in recessionary territory and the U.S. experiencing a very slow recovery. By 2013, the U.S. recovery was in its fifth year, albeit with growth rates checking in below those of previous economic recoveries. As the year progressed, Europe emerged from recession and growth in the U.S. began to accelerate. Final U.S. GDP growth for the second half of the year came in at 3.25% compared to just 1.8% (as reported by the Bureau of Economic Analysis) during the first half of the year; Congress passed a bipartisan budget deal; and the Federal Reserve announced official plans to begin tapering asset purchases. All of these positive factors contributed to the large valuation change in the market as the S&P 500 P/E multiple expanded from 12 times to 15 times forward earnings. As the chart shows, this expansion of multiples served as the primary driver of performance in 2013 by contributing over two-thirds of the annual return to the S&P 500. Valuation adjustments such as these, with steep increases in P/E ratios, do not occur frequently and may only happen once during a complete economic cycle.

Year-to-date market returns have been impacted by economic uncertainty as a brutally cold winter clouded investors’ views of the true underlying growth rate of the economy. Despite this set-back, we continue to expect GDP growth to accelerate, leading to economic growth in the 2-3% range for the full year. While we expect the global economic growth picture to continue to brighten, in 2014 we aren’t anticipating a large contribution from multiple expansion (the gray area of the chart) to fuel domestic stock market performance. The forward P/E of the S&P 500 is now squarely in-line with long-term historical averages of 15x. Essentially, we are back to the “old normal.” Earnings and dividend growth will likely be the primary driver of market returns, suggesting a mid-single-digit return in 2014 is a reasonable assumption.

The Sand Hill Global Advisors philosophy is to position portfolios to withstand an environment that may be impacted by typical market fits and starts. While 2013 was characterized by very low volatility, we anticipate 2014 trends will be more normalized. Our clients will be well served by a balanced portfolio and our contrarian approach that is designed to take advantage of volatility over time.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.